Farmers Warn of Serious Impact from Proposed Inheritance Tax Changes

As the Finance Bill heads for its Second Reading on 16th December, farmers and rural business owners across Cornwall are warning of a crisis they say could reshape the countryside for generations.

What the Finance Bill Would Change

The proposals, announced in the Autumn Budget, would alter Agricultural Property Relief and Business Property Relief. From April 2026, inheritance tax would apply to family farms and rural businesses valued over £1 million.

While ministers have suggested that only the wealthiest would be affected, analysis from the Country Land and Business Association says otherwise. According to the organisation, a typical 200 acre arable farm making a profit of £27,300 could face an inheritance tax bill of £435,000. Spread over ten years, that would amount to 159 percent of annual profits.

The CLA’s modelling suggests that many farms could be forced to sell up to 20 percent of their land to pay the tax. They say the effects would be felt across rural Cornwall.

The Predicted Impact on Cornwall’s Countryside

According to the CLA, the changes would:

• Devastate investment in the rural economy, with uncertainty already halting essential infrastructure

• Undermine food security by reducing productive land

• Disrupt long term planning for environmental improvements and regenerative farming

• Break up family businesses that have supported rural communities for generations

Ann Maidment, the CLA’s Regional Director for the South West, warns that ministers are treating multigenerational businesses as a problem rather than recognising their importance. She said: “Ministers say they’re targeting people who buy farmland as a tax shelter, but whether through ideology, inexperience or a fundamental misunderstanding of how family businesses work, it is treating multigenerational businesses as a problem to be solved rather than the bedrock of long-term investment.”

The CLA says the financial strain is only part of the picture. Business owners have reported that family conversations now revolve around death and tax, with the emotional burden mounting as they fear their life’s work could be taxed out of existence.

Pressure on Labour MPs in Cornwall

Ann Maidment says Labour MPs must now decide whether to support the government or stand with the people who elected them. She added: “Many Labour MPs were elected on promises that the countryside was safe in their hands. They fought hard for rural seats, building trust with farming communities and rural business owners. But before they could deliver on those promises, the government announced these changes with no consultation.

“Now MPs face a stark choice: will they stand with the government that has undermined their election pledges, or will they stand with their constituents, the family businesses that have kept local economies going for generations?”

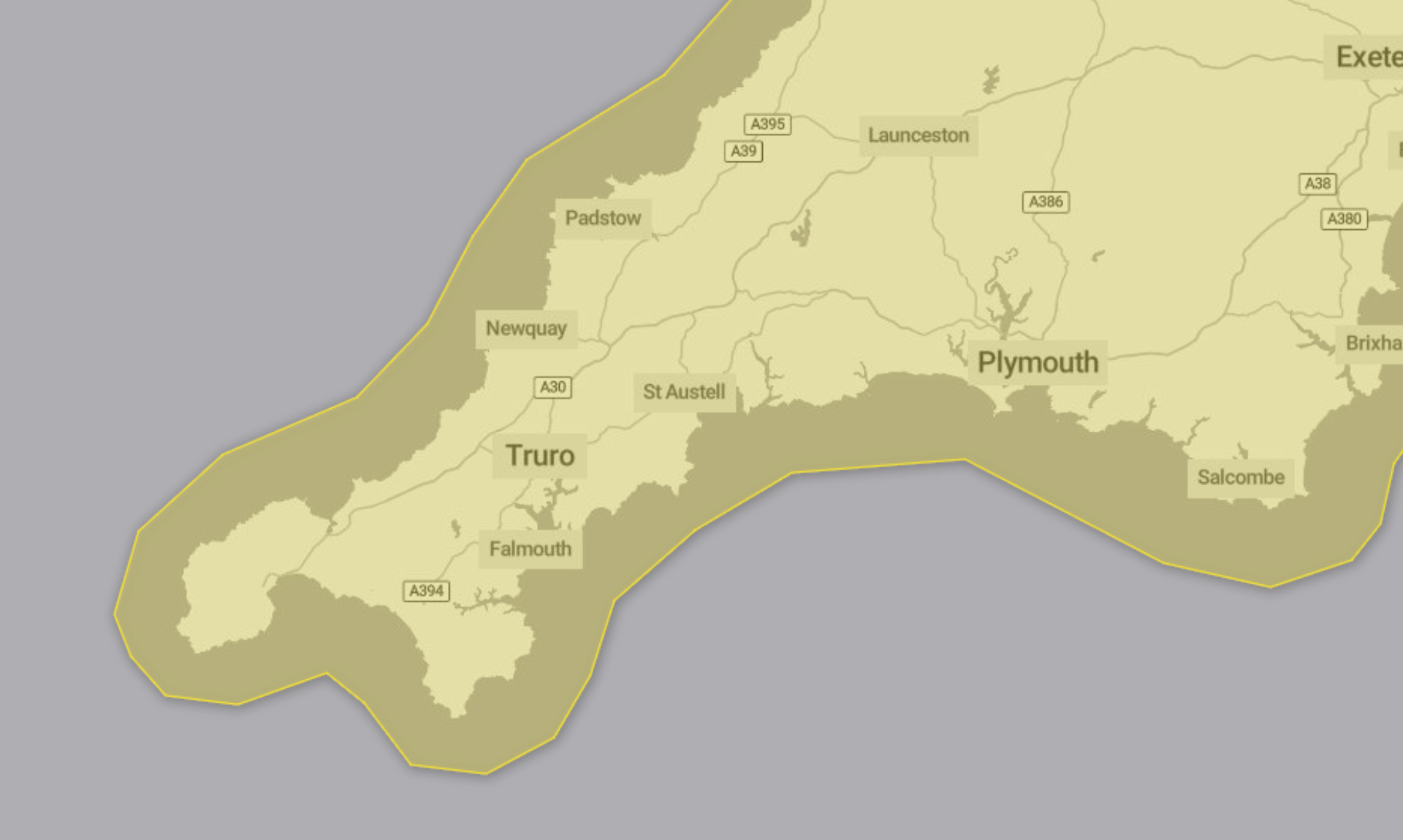

The CLA has written to MPs across Cornwall, including Perran Moon for Camborne and Redruth, Noah Law for St Austell and Newquay, and Jayne Kirkham for Truro and Falmouth.

Residents Urged to Contact Their MPs

The organisation is encouraging farmers, rural business owners and residents to write to their MP immediately, outlining how the proposed changes would affect their family, business and wider community. They are also urging people to invite MPs to visit their farms so they can see the human impact for themselves.

More details on the inheritance tax proposals and how to contact your MP can be found on the CLA website at www.cla.org.uk.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Don’t Miss What’s Happening in Cornwall

Join others in Cornwall by receiving the latest daily news in Cornwall, sent direct to your inbox.