More Than £13m in Business Start Up Loans Issued Across the South West in 2025

More than 1,000 start ups and early stage businesses across the South West secured funding through the British Business Bank’s Start Up Loans programme in 2025, new figures show.

The number of loans issued in the region rose by 6.34% compared with 2024, increasing from 946 to more than 1,000. Over the year, businesses borrowed a total of £13.89m, up 12% on the £12.4m loaned the year before.

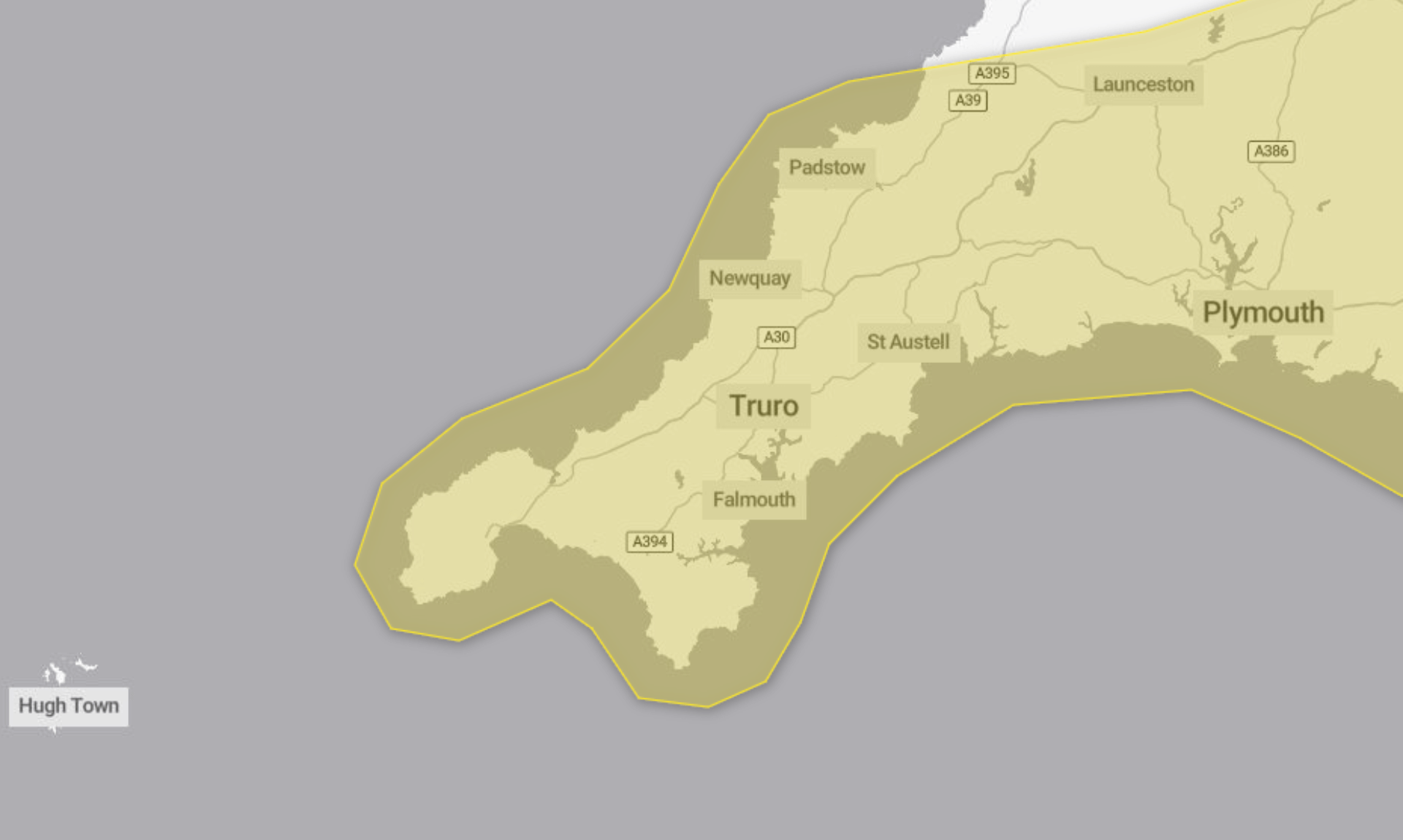

Cornwall Among Top Areas for Funding

Cornwall was the highest funded local authority area in the South West, with businesses receiving £1.6m in Start Up Loans during 2025.

Four other areas also recorded more than £1m in lending. These were Somerset with £1.3m, Wiltshire with £1.3m, Bournemouth, Christchurch and Poole with £1.2m, and the City of Bristol with £1.1m.

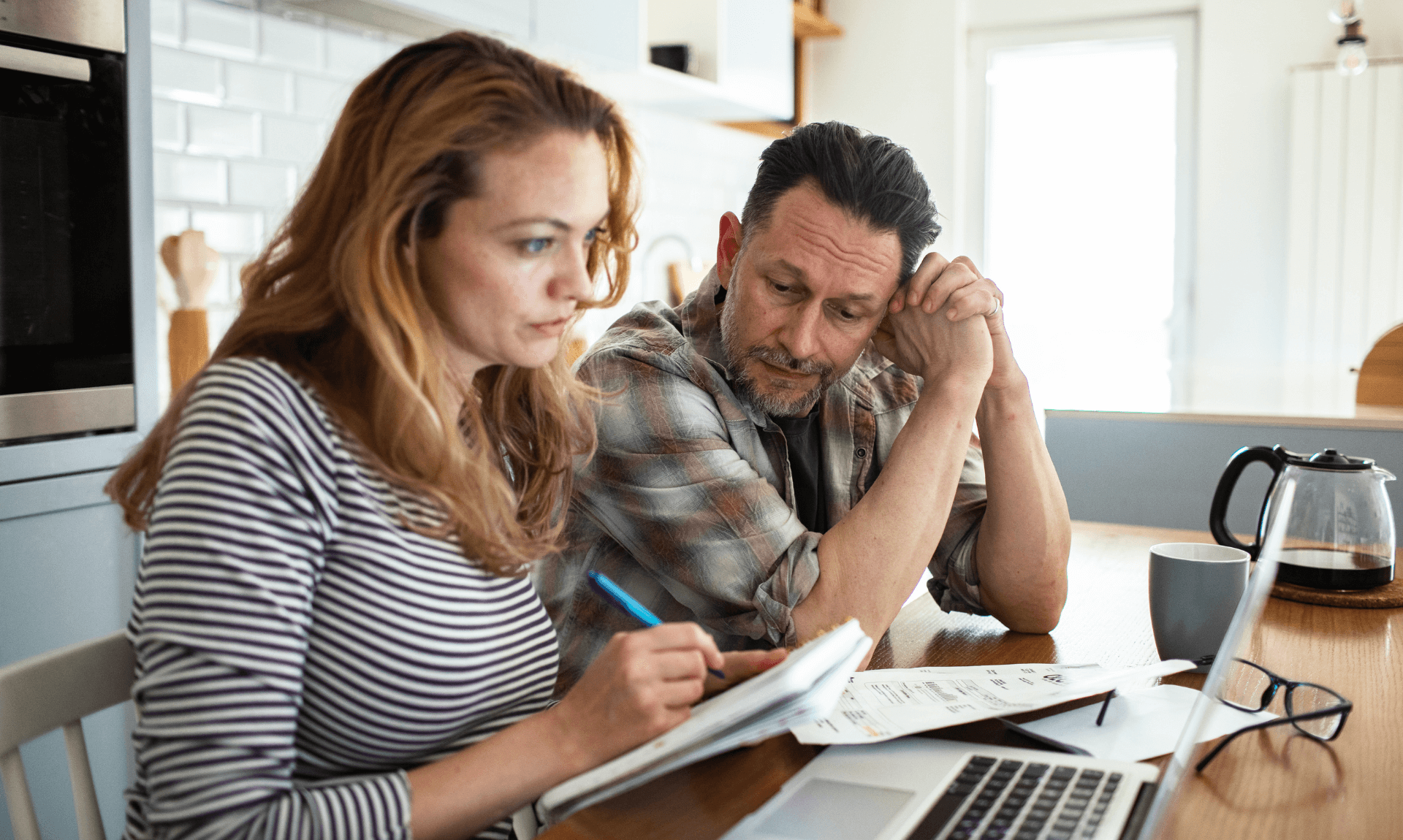

Strong Demand Despite Confidence Concerns

Across the UK, demand for Start Up Loans remained steady throughout the year. Each quarter of 2025 saw similar levels of borrowing, with loan volumes peaking between July and September when 2,936 loans worth £36.18m were issued.

December stood out nationally, with loan volumes 12% higher than in December 2024.

This sustained demand comes at a time when wider business confidence has dipped. The latest survey from the British Chamber of Commerce found that only 46% of responding firms expected an increase in turnover, the lowest level in three years. Meanwhile, the Lloyds November Business Barometer reported an eight point fall in confidence to 42%.

Support for Underrepresented Founders

National figures show that 39% of Start Up Loans in 2025 went to female founders. Loans to ethnic minority entrepreneurs accounted for 21%, while 8% were taken out by Gen Z founders aged between 18 and 24.

All three groups are identified as traditionally facing greater barriers when accessing start up finance.

January and December Remain Key Months

According to the British Business Bank, the festive period continues to be an important time for people considering self employment or a new business venture.

Louise McCoy, Managing Director of Start Up Loans Products at the British Business Bank, said demand across the South West continued to grow year on year, despite mixed signals from wider confidence data. She also noted that December 2025 saw a much higher volume of loans than the same month in 2024.

Further Guidance Available

Start Up Loans offers personal loans for business purposes of up to £25,000 per partner or owner, with a maximum of £100,000 per business. Loans come with fixed interest rates and include free mentoring support for one year.

Further business guidance is available on the Start Up Loans website, alongside information for those considering self employment through its Fresh Start Guide.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Don’t Miss What’s Happening in Cornwall

Join others in Cornwall by receiving the latest daily news in Cornwall, sent direct to your inbox.