Unlock Lower Mortgage Rates in Cornwall with New “Own New Rate Reducer” Scheme

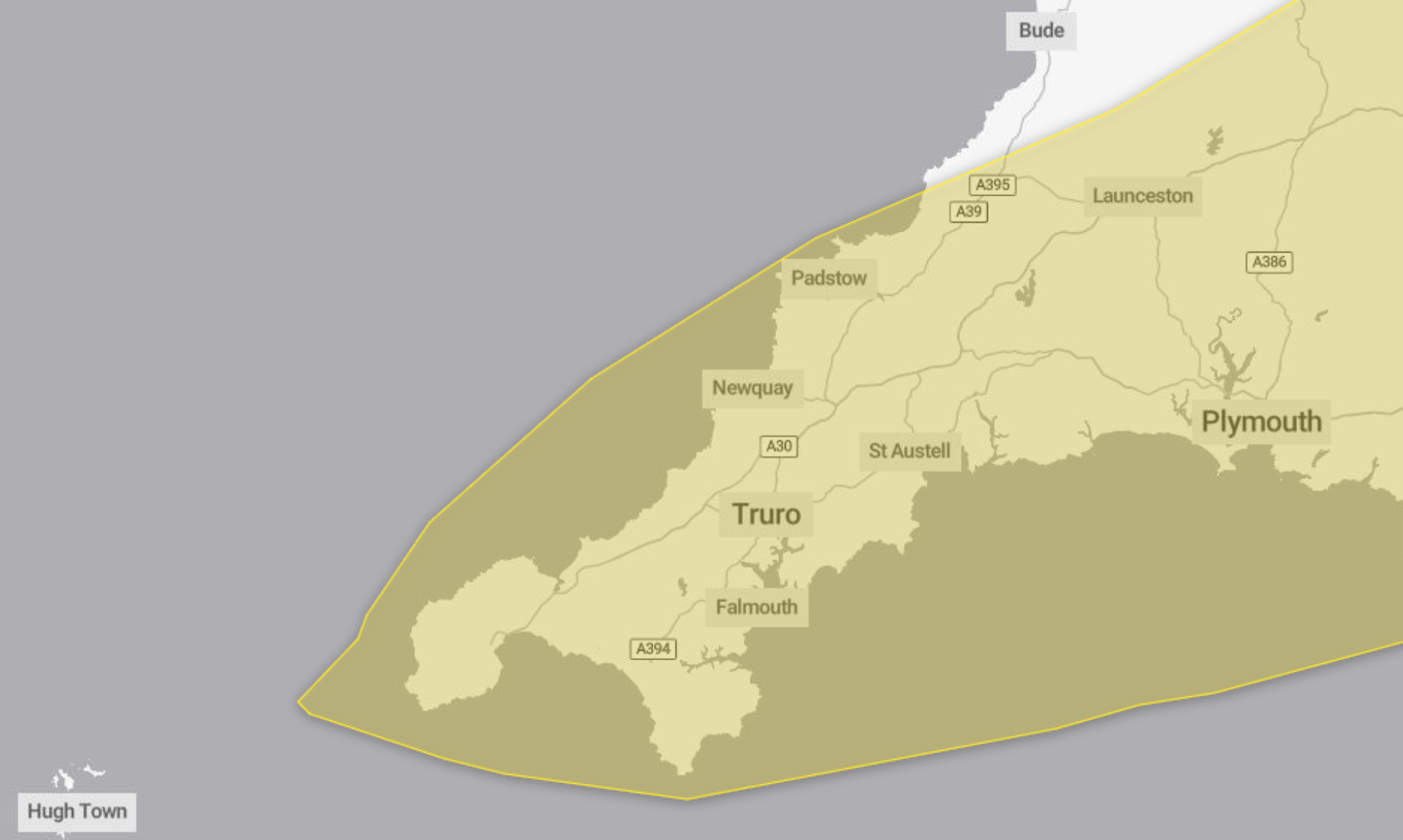

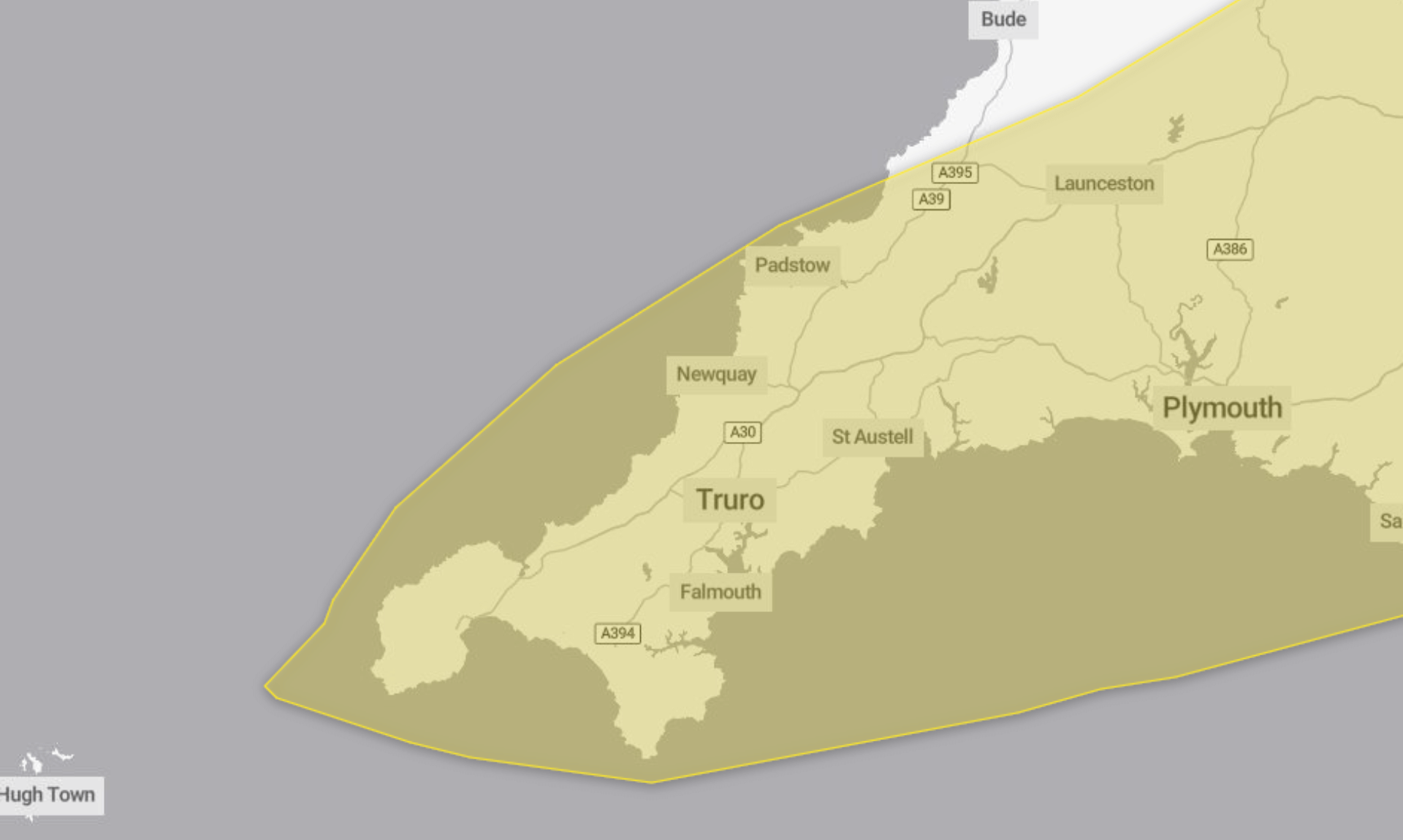

In an exciting development for prospective homebuyers in Cornwall, the newly launched Own New Rate Reducer product is set to make mortgages more affordable.

This innovative scheme, a collaboration between Halifax, Virgin Money, and Barratt Developments, promises to shake up the local real estate market by offering reduced mortgage rates through specific incentive strategies employed by housebuilders.

Revolutionary Mortgage Solution

The Own New Rate Reducer utilises the incentive budgets that housebuilders offer, applying these funds directly to decrease mortgage interest rates for buyers. This approach not only lowers monthly payments but also allows buyers to pay more towards the capital value of their mortgage early on. Rates under one percent could be accessible to those with substantial deposits or equity, making this an enticing option for many.

How It Works

Here’s how the Rate Reducer works: if a housebuilder provides a five percent incentive on a home, that amount is used to reduce the mortgage interest, which lowers the monthly payments for the initial term of two to five years, depending on the lender’s criteria. This scheme ensures that the buyers’ monthly outgoings are significantly reduced during this period.

Lender Participation and Benefits

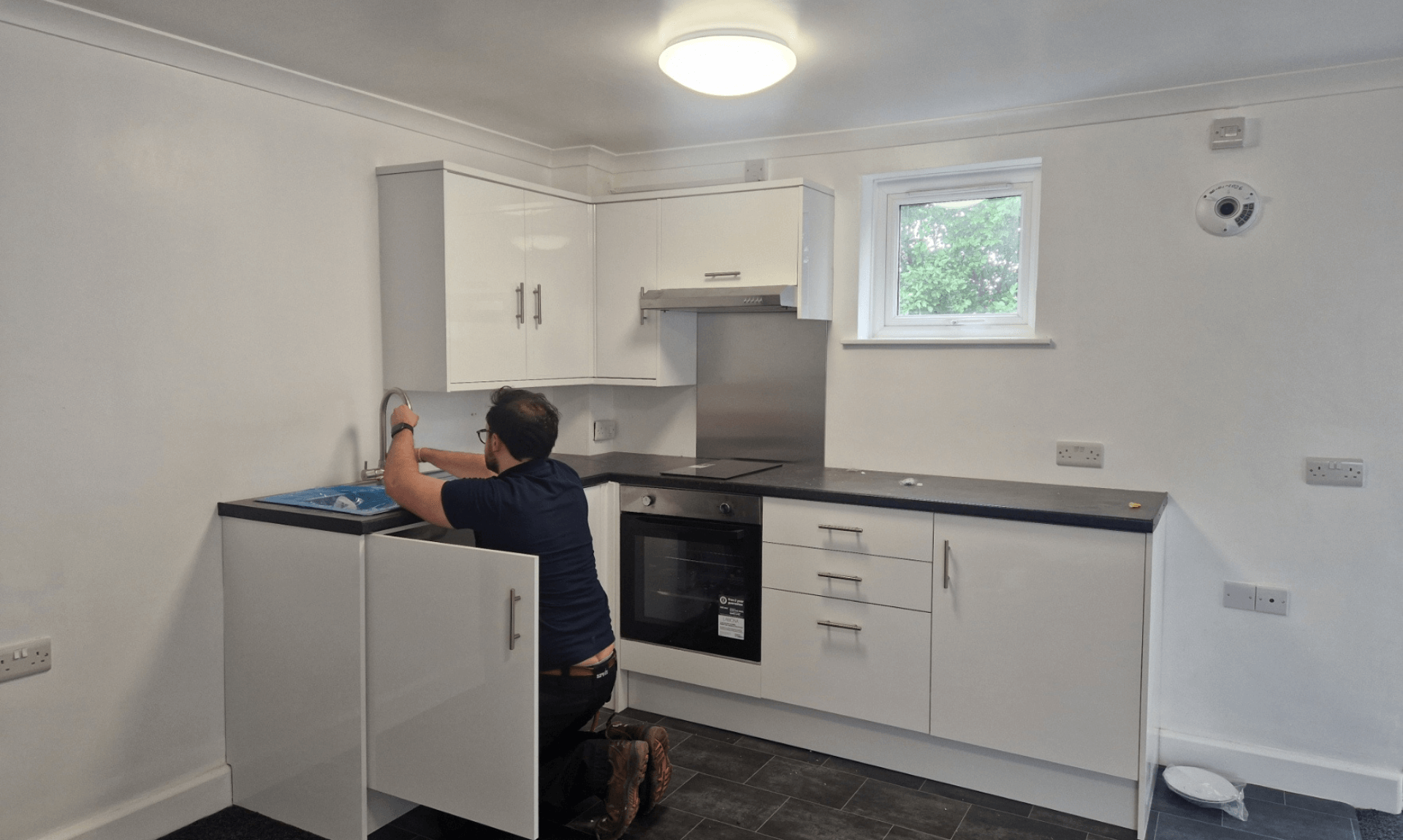

Both Virgin Money and Halifax are foundational lenders in this scheme, offering these lower rates through the new product. Craig Calder from Virgin Money highlighted the product’s benefits, saying it provides “certainty of a lower fixed interest rate over the initial period,” thus enhancing buyer confidence and satisfaction. Amanda from Halifax reiterated the advantages, emphasizing the flexibility and choices offered to customers, particularly beneficial for those setting up new homes.

Eligibility and Application

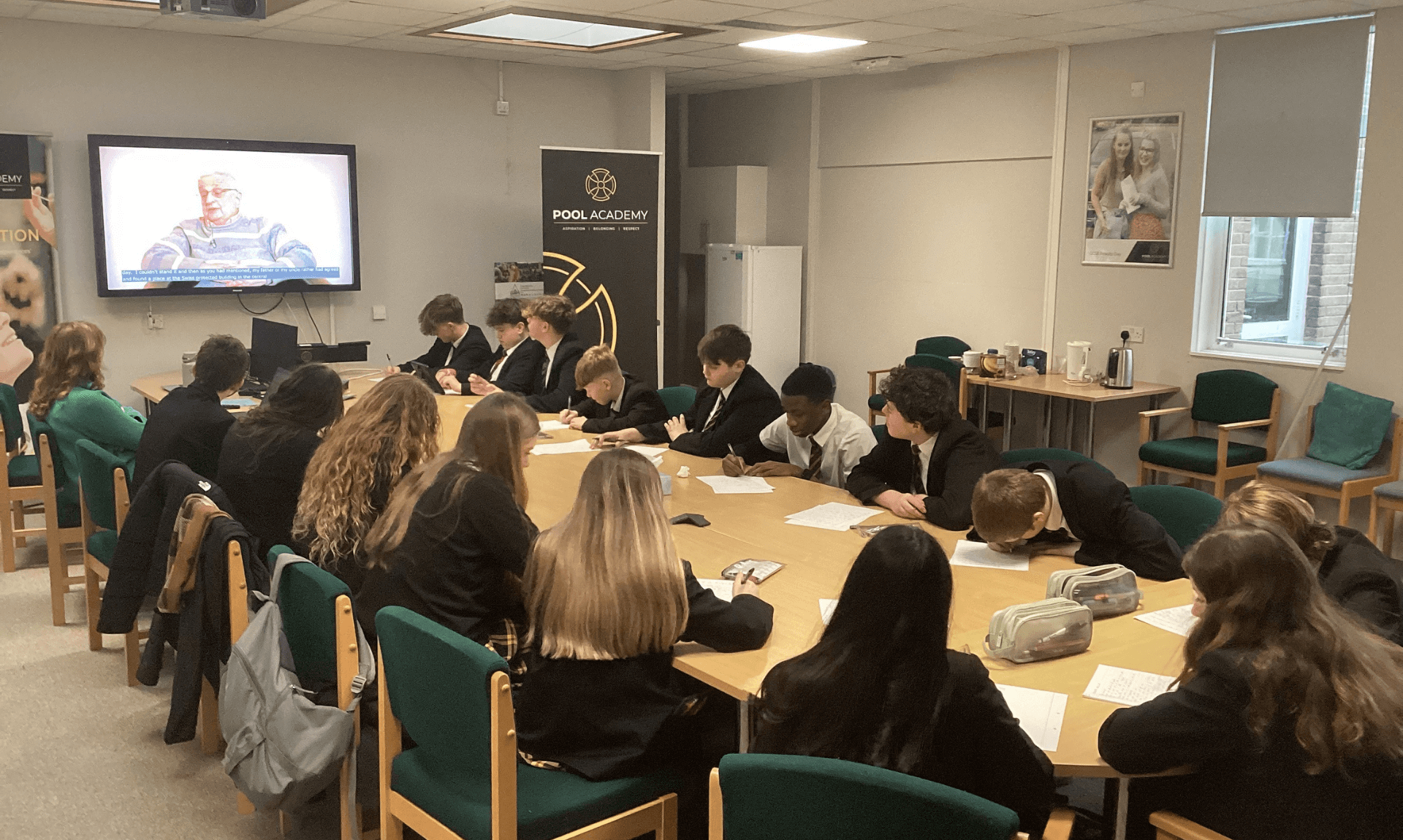

To benefit from the Own New Rate Reducer, customers will need to select a home available under the scheme from participating housebuilders. A network of specially trained mortgage brokers will then assist buyers in applying and taking full advantage of the reduced rates.

Building a Better Future

With Barratt Developments leading the charge, soon to be joined by 60 more housebuilders, the scheme aims to bolster home ownership rates. Barratt Homes and David Wilson Homes are already putting this plan into action at their new development site at Treledan in Saltash, where they continue to build much-needed new homes.

Own New: Innovating Home Ownership

Founded by Eliot Darcy after his own challenges with securing a mortgage, Own New aims to democratise the home-buying process, making it more accessible regardless of buyers’ financial backing from family. This product builds on the success of their earlier Deposit Drop product, which has already aided many in the North East and Yorkshire since early 2023.

For more details on how to apply for the Own New Rate Reducer and to view eligible properties, prospective buyers should visit OwnNew.co.uk.

Share This Story, Choose Your Platform!

To keep up with the latest cornish news follow us below

Follow CornishStuff on Facebook - Like our Facebook page to get the latest news in your feed and join in the discussions in the comments. Click here to give us a like!

Follow us on Twitter - For the latest breaking news in Cornwall and the latest stories, click here to follow CornishStuff on X.

Follow us on Instagram - We also put the latest news in our Instagram Stories. Click here to follow CornishStuff on Instagram.

You Might Also Be Interested In

Don’t Miss What’s Happening in Cornwall

Join others in Cornwall by receiving the latest daily news in Cornwall, sent direct to your inbox.